Epymetheus: Multi-asset Backtesting Framework

Epymetheus is a multi-asset backtesting framework. It features an intuitive user API that lets analysts try out their trade strategies right away.

Installation

$ pip install epymetheus

Features

- Intuitive and Pythonic API

- Epymetheus designs Pythonic API that lets you code your idea intuitively without any fuss.

- Trading strategies can be readily coded as ordinary functions and then you can

run()andscore()it right away.

- Blazingly Fast Computation

- Backtesting is boosted by NumPy and so you can give your own idea a quick try.

- Executions of profit-taking and stop-loss orders are built-in.

- Seamless Connection with Pandas

- You can use

pandas.DataFrameof historical prices as the target of backtesting. - You can view the result of backtesting in Pandas format so that you can analyze and plot it using the familiar Pandas methods.

- You can use

- Full Test Coverage:

- Epymetheus is thoroughly tested by continuous integration with 100% code coverage.

Integrations

Your trading strategy may incorporate various libraries out there, for instance,

- Machine Learning - scikit-learn, PyTorch, TensorFlow, etc.

- Econometrics - statsmodels, Prophet, etc.

- Technical Indicators - TA-Lib, etc.

- Hyperparameter Optimization - Optuna (Example follows), etc.

How to use

Create strategy

Let's construct your trading strategy. The following "dumb strategy" will,

- target a set of stocks whose

DataFrameof historical prices is given byuniverse. - buy the cheapest stock with your monthly allowance $100, and

- place a profit-taking order when your profit exceeds $

profit_takeand place a stop-loss order when your loss exceeds $stop_loss.

Here in the function dumb_strategy, the first argument universe is mandatory while the other arguments are parameters that you can define freely.

import pandas as pd

import epymetheus as ep

def dumb_strategy(universe: pd.DataFrame, profit_take, stop_loss):

# I get $100 allowance on the first business day of each month

allowance = 100

for date in pd.date_range(universe.index[0], universe.index[-1], freq="BMS"):

cheapest_stock = universe.loc[date].idxmin()

# Find the maximum number of shares that I can buy with my allowance

n_shares = allowance // universe.at[date, cheapest_stock]

trade = n_shares * ep.trade(cheapest_stock, date, take=profit_take, stop=stop_loss)

yield trade

You can now create your strategy with specific parameters as:

my_strategy = ep.create_strategy(dumb_strategy, profit_take=20.0, stop_loss=-10.0)

Run strategy

Now you can backtest your strategy with any universe, for instance, US stocks.

from epymetheus.datasets import fetch_usstocks

universe = fetch_usstocks()

universe.head()

# AAPL MSFT AMZN BRK-A JPM JNJ WMT BAC PG XOM

# 2000-01-01 0.785456 37.162327 76.1250 56100 27.773939 27.289129 46.962898 14.527933 31.304089 21.492596

# 2000-01-02 0.785456 37.162327 76.1250 56100 27.773939 27.289129 46.962898 14.527933 31.304089 21.492596

# 2000-01-03 0.855168 37.102634 89.3750 54800 26.053429 26.978193 45.391777 14.021359 30.625511 20.892334

# 2000-01-04 0.783068 35.849308 81.9375 52000 25.481777 25.990519 43.693306 13.189125 30.036228 20.492161

# 2000-01-05 0.794528 36.227283 69.7500 53200 25.324482 26.264877 42.801613 13.333860 29.464787 21.609318

my_strategy.run(universe)

# 240 trades returned: trade(['BAC'], lot=[3.], entry=2019-12-02 00:00:00, take=20.0, stop=-10.0) ... Done. (Runtume: 0.1034 sec)

# 240 trades executed: trade(['BAC'], lot=[3.], entry=2019-12-02 00:00:00, take=20.0, stop=-10.0) ... Done. (Runtime: 0.2304 sec)

# Done. (Runtime: 0.3338 sec)

Trade history and wealth

Trade history can be viewed as:

df_history = my_strategy.history()

df_history.head()

# trade_id asset lot entry close exit take stop pnl

# 0 0 AAPL 115.0 2000-01-03 2005-01-07 None 20.0 -10.0 23.527901

# 1 1 AAPL 129.0 2000-02-01 2000-09-29 None 20.0 -10.0 -48.437450

# 2 2 AAPL 99.0 2000-03-01 2005-07-14 None 20.0 -10.0 24.924913

# 3 3 AAPL 97.0 2000-04-03 2005-07-14 None 20.0 -10.0 22.180065

# 4 4 AAPL 104.0 2000-05-01 2005-05-19 None 20.0 -10.0 20.736752

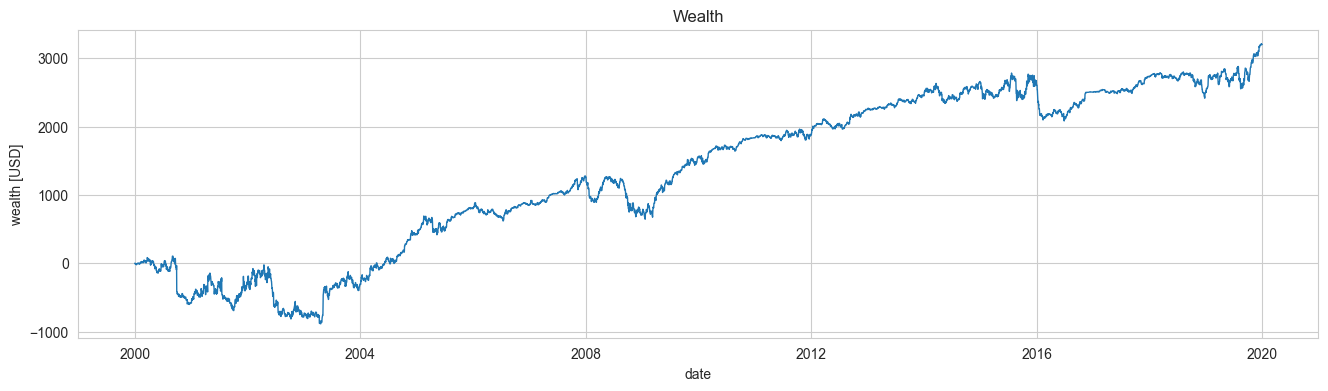

The time-series of wealth can be viewed as:

series_wealth = my_strategy.wealth()

series_wealth.head()

# 2000-01-01 0.000000

# 2000-01-02 0.000000

# 2000-01-03 0.000000

# 2000-01-04 -8.363557

# 2000-01-05 -7.034265

# Freq: D, dtype: float64

Scores

You can quickly score() the metrics of the strategy.

my_strategy.score("final_wealth")

# 3216.74

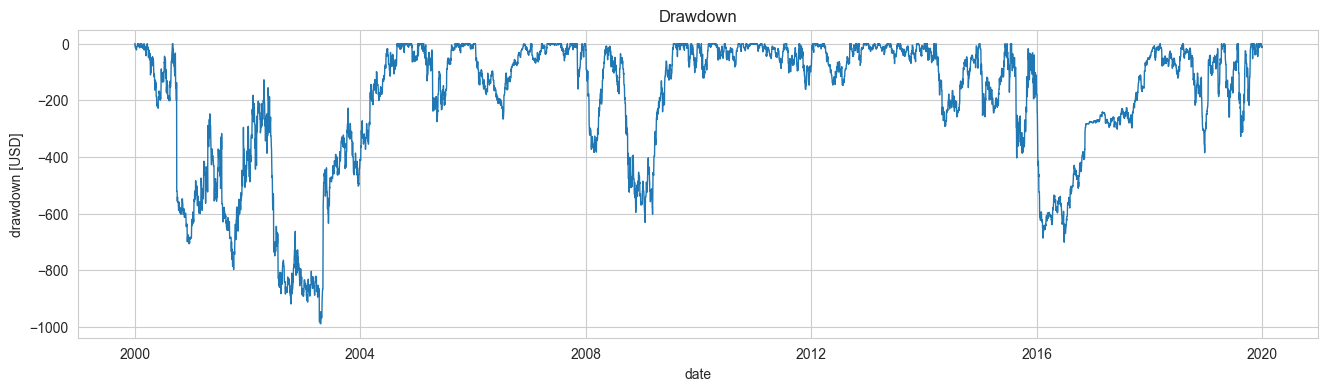

my_strategy.score("max_drawdown")

# -989.19

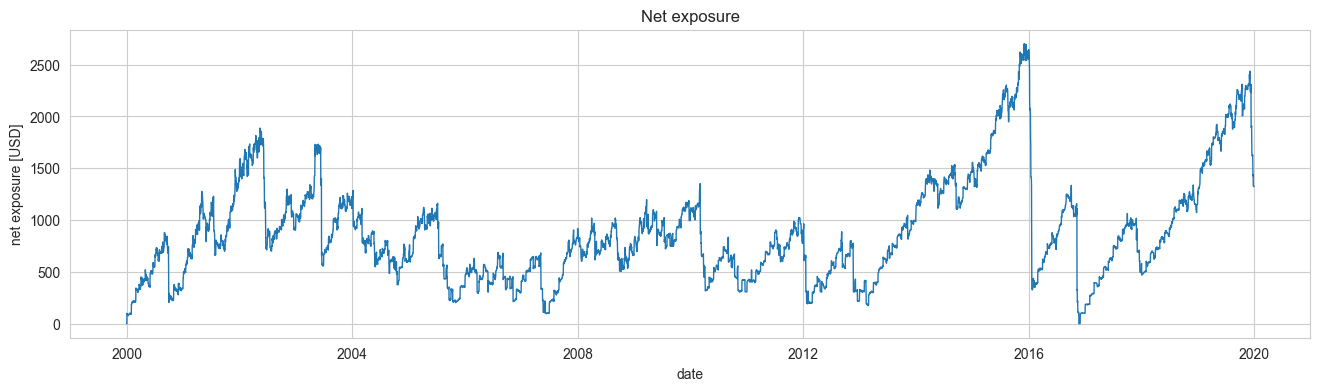

You may compute various time-series.

drawdown = my_strategy.drawdown()

exposure = my_strategy.net_exposure()

More examples

Optimization

You may optimize the parameters of your strategy using Optuna for example.

Remember that optimization for backtesting is dangerous.

import optuna

def objective(trial):

profit_take = trial.suggest_int("profit_take", 10, 100)

stop_loss = trial.suggest_int("stop_loss", -100, -10)

my_strategy = ep.create_strategy(

dumb_strategy,

profit_take=profit_take,

stop_loss=stop_loss,

).run(universe, verbose=False)

return my_strategy.score("final_wealth")

study = optuna.create_study(direction="maximize")

study.optimize(objective, n_trials=100)

study.best_params

# {'profit_take': 100, 'stop_loss': -42}

Pair trading

Trade can include multiple stocks.

Profit-take and stop-loss will be executed when the total profit/loss exceed thresholds.

def pair_trading_strategy(universe, param_1, ...):

...

# Buy 1 share of "BULLISH_STOCK" and sell 2 shares of "BEARISH_STOCK".

yield [1, -2] * ep.trade(["BULLISH_STOCK", "BEARISH_STOCK"], stop=-100.0)